Investor Note: Due to opportunities in the historic US coin market to procure discounted volume groupings, grading service preferences and date-specific options, all transactions and quotes for graded $20 gold pieces are handled via phone only. Please call with your inquiry.

$20 Gold Piece 5-Piece Index Set

Includes: $20 Liberty Mint State 63 & 64;

$20 St. Gaudens Mint State 63, 64 & 65

(One each)

All graded by PCGS or NGC

Semi-numismatic items

____________________________________________________________________

Interested in gold but struggling to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100

[email protected]

___________________________________________________________________

The Mint State grading scale for semi-numismatic gold coins can be explained fairly simply: As you move higher in grade from MS63-MS65, the condition of the coins improves and their scarcity increases (total availability decreases). The value of that scarcity is represented through the coin's 'premium', or value the coin carries above and beyond the value of its underlying gold content. The premium a coin carries is typically the result of the interaction of the coin's rarity (it's limited supply) as well as it's overall demand.

Price risk/reward in these type of coins is divided into two categories: Premium risk/reward, which is the risk associated with value the coins carry above the spot price of gold, and spot gold price risk/reward, which is the value change attributed to the rise and/or fall of the spot price of gold itself. With regard to premiums, investors seek to purchase at a level where the premium is at or near an their all time lows, for in so doing, exposure to loss of value through declining premiums is mitigated. Simpy put, by buying 'right' investors can enjoy all the increased upside potential inherent in these coins without adding substantially more risk to their position than that of gold itself. That said though, if one buys when premiums are too high, that investor stands to see compounded losses if both gold and premiums should decline together, or risks abbreviated gains should spot gold prices move higher, but premiums simultaneously move lower.

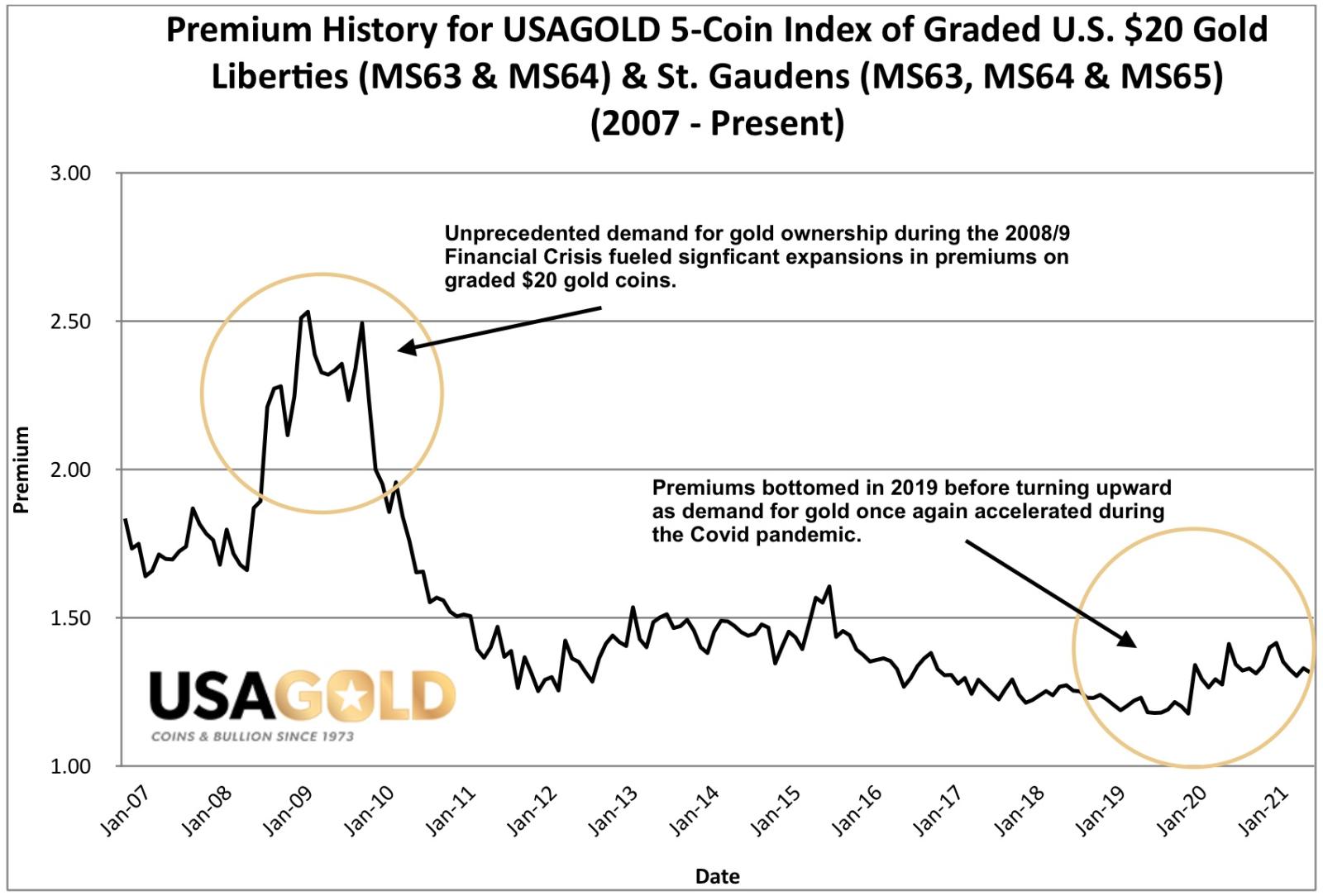

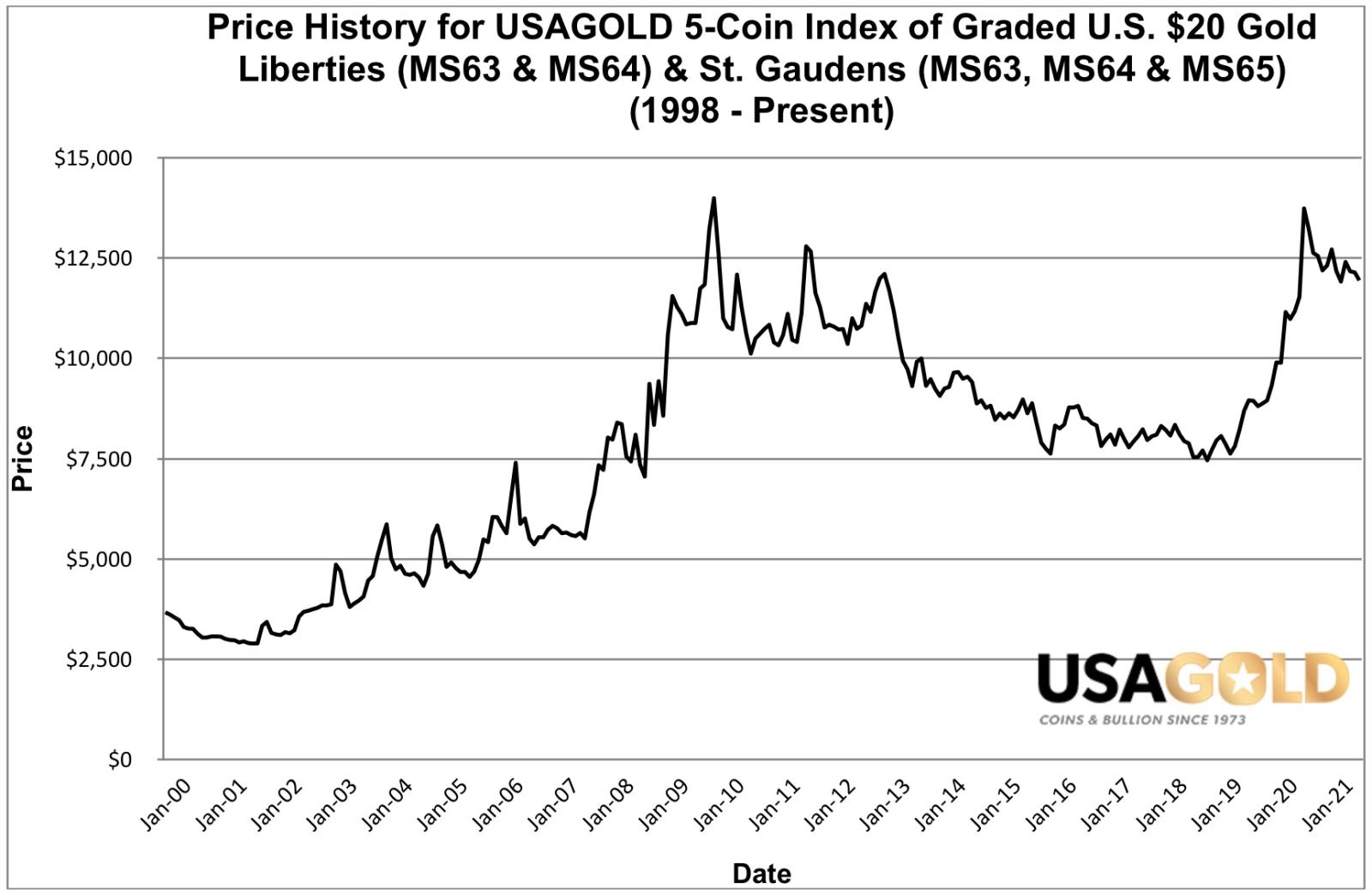

Charted here is the USAGOLD Index of Graded $20 Gold Pieces - Premium (above) & Price (below). The Index of Graded $20 Gold Pieces contains one each Mint State (MS) 63 and MS 64 United States $20 Liberty coins and one each MS63, MS64, and MS65 $20 St. Gaudens gold coins, and combines them into a five-coin market index. This index removes the volatility possible when tracking individual coins to provide a more accurate general market snapshot for graded $20 gold pieces.

Take some time to study these charts closely. The premium as listed on the y (vertical)-axis should be read as a multiplier of the gold price. In other words, a coin premium of 2.00 is equal to double the gold price, and a coin premium of 3.00 is equal to 3 times the gold price.

Please note the periods of premium expansion. The most notable spike occurred during the Financial Crisis in late 2008/early 2009 and then previously in 1999 in the lead up to Y2K (not charted). When gold demand is peaking, the inherently tight supply of these items is most evident. It is for this reason that these coins are said to be an investment in gold, as well as an invesment in the demand for gold.

It is for this reason that numerous safe-haven oriented investors see these items as productive components in a well diversified gold portfolio. On one hand, they are securing pre-1933 positions, which are widely considered to be the 'safest' from of gold ownership because of their ability to protect/insulate against government intrusion risks. On the other, they stand positioned to capitalize most when the desire to own physical gold peaks - a phenomenon that typically coincides with economic turmoil and destabilized market conditions - precisely that which the safe-haven gold owner seeks primarily to hedge against.

In short, the graded $20 gold piece market works well for those looking to increase the risk/reward factor in their gold holdings. If approached carefully and prudently, investors can enjoy great success in this market. Due simply to the fact that these coins trend with the gold price rather than track it directly, we encourage investors to avoid utilizing these coins as the sole position in one's gold holdings, but instead as a component in a balanced portfolio. We recommend a three to five year minimum holding period for these items.

_________________________________________________________________________________